When Wells Fargo (WFC) reported first-quarter earnings that beat expectations (albeit on a non-GAAP basis), its revenue also fell by 18% year-on-year. The quarter only included a partial lock-down that became a full-scale one in the United States, is WFC stock at risk of re-testing the $26 lows reached earlier this month? If the bank maintains its dividend and does not require another provision on its loans in 2020, the stock might stop falling from current levels.

Source: Wells Fargo

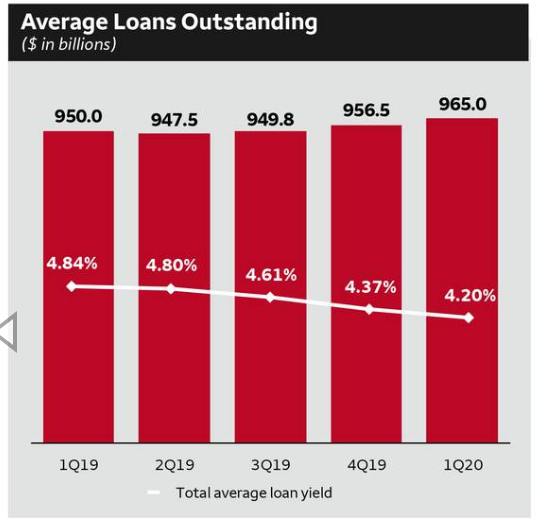

Wells Fargo identified falling loan yields and pressured margins back in 2018 when it blamed unfavorable loan mix changes. As the economy worsens, expect higher pressure on the auto loan and mortgage loan segments of the bank’s business.

In the first quarter, the bank took a $4 billion provision to cover credit losses. This is as follows:

- $2.9 billion reserves for loans

- $909 million of net charge-off for loans

- $172 million of provision expenses for debt securities

Source: Wells Fargo

It recorded a $950 million charge on securities impairment and another $621 million in net losses related to deferred compensation plan investment results.

In all, this resulted in GAAP earnings per share of one cent, missing expectations by 52 cents.

Pressure on Loan Portfolio

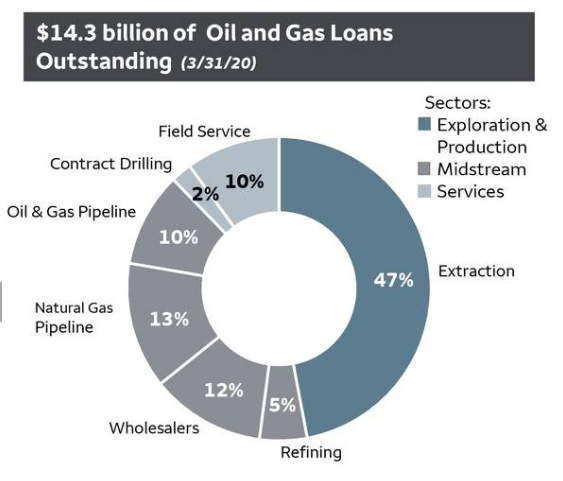

The bank’s oil and gas loan portfolio is worth $14.3 billion. The drop in oil prices may lead to delinquencies.

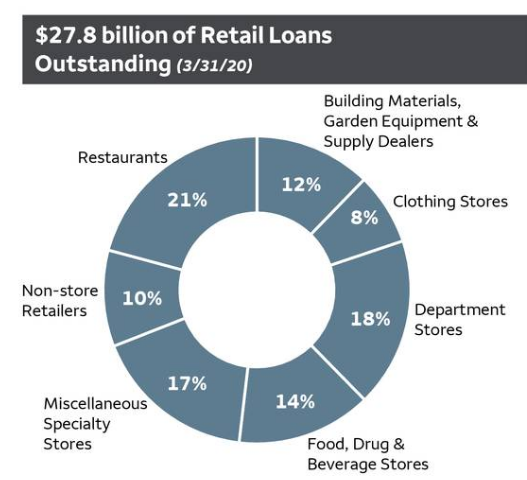

Similarly, in retail, restaurants are especially at risk of keeping up with loan payments. But if the U.S. selectively re-opens businesses and includes restaurants, then the bank may not need to apply its provisions on restaurant loans worth $5.8 billion.

Source: Wells Fargo Q1 earnings call presentation

Wells Fargo has $16.2 billion worth of loans in the entertainment and recreation. It noted that its exposure to cruise lines is less than 1% of the outstanding loans. Still, companies in the gambling industries (17%) and sporting goods, boats and RVs segment need to preserve cash flow to avoid defaulting.

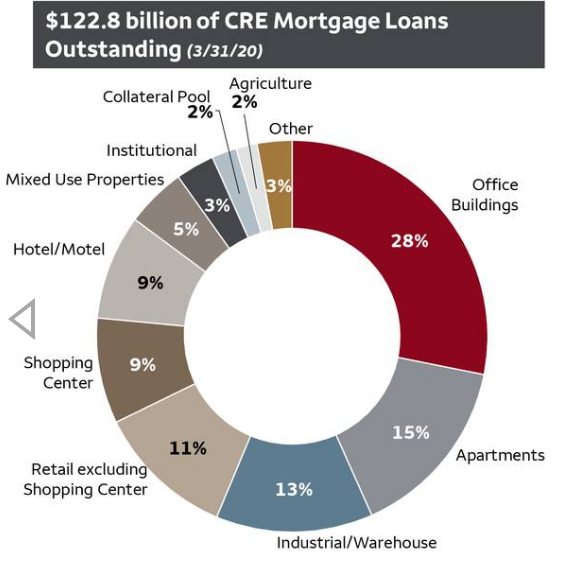

CRE mortgage loans worth $122.8 billion is the bank’s biggest liability. Yet businesses will still need to maintain their presence in office buildings. Once again, as the coronavirus spread in the U.S. drops sharply and businesses re-open, Wells Fargo will not need to write-down much of its office building loans.

Opportunity

Wells Fargo’s deposits grew 6% year-on-year to $1.3 trillion in the first quarter. Its average deposit cost fell 52 basis points to 0.52%. This is a result of a deposit campaign run in early 2019. Looking ahead, if customers slow their rate of mortgage payoffs and withdraw funds to pay for bills, the deposit balance may fall next quarter.

Expect strong customer retention as the bank offered fee waivers and payment deferrals to more than 1.3 million of its consumers and small business owners. By waiving fees worth $30 million, its customers will appreciate its assistance. Plus, Wells Fargo planned a minimum hourly pay raise ranging from $15 to $20. Though this pay increase will take effect by the end of the year, satisfied staff will give customers higher quality service.

Not a 2008 Moment

On the conference call, Wells Fargo thought the financial crisis was far worse for, for example, its auto portfolio. CFO John Shrewsberry said “And so if things play out substantially worse, then there’s certainly the possibility that we end up building more or experiencing more charge-offs or both, but we feel good about the approach that we’ve taken in March developing our scenarios with our governance around it and coming into the quarter-end.”

The bank also modeled a Comprehensive Capital Analysis and Review that did not include a stimulus. In this scenario, it forecast a “peak quarterly loss rates expressed on an annualized basis of about 1.7%, 1.75% and an average of about 1.2%.”

While forecasting future unemployment and GDP will prove difficult, the bank has a stronger portfolio than the last crisis. Ultimately, the risk to its business depends on how long the shutdown continues.

Valuation and Your Takeaway

Stock Rover pegs WFC stock has a fair value of $45.26. This is not far from the analyst consensus price target averaging $41.73. In reality, the stock value depends on the duration of the shutdown and the ability of the U.S. to contain the coronavirus spread. So, as restrictions ease in the coming weeks, WFC stock may trend higher. The improving sentiment will outweigh worries of further earnings losses or higher provisions.

Please [+]Follow me for coverage on beaten up dividend-income stocks. Click on the “follow” button beside my name. Do not let the market sway you. Instead, join DIY investing today.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in WFC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Why Buy Wells Fargo Despite The Loan Risks

0 Comments: